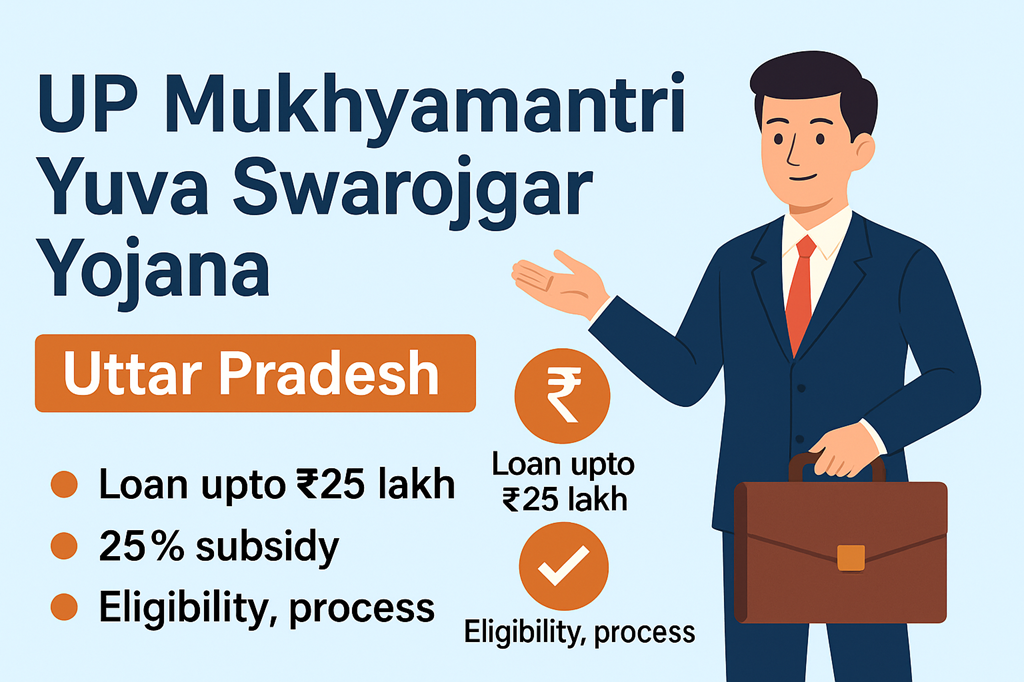

UP Mukhyamantri Yuva Swarojgar Yojana 2025

The UP Mukhyamantri Yuva Swarozgar Yojana is a self-employment scheme launched by the Uttar Pradesh government to help unemployed youth start their own business. Under this scheme, eligible applicants can get financial assistance and a subsidy from the government. It mainly targets those who have the skills and motivation to work independently but lack capital. The scheme provides loans of up to ₹25 lakh for manufacturing and ₹10 lakh for service businesses. It is a great opportunity for youth who want to become job creators instead of job seekers.

Through the UP Mukhyamantri Yuva Swarozgar Yojana, the UP government wants to encourage entrepreneurship and reduce unemployment in the state. It is implemented by the Department of Micro, Small and Medium Enterprises (MSME). All eligible youths between 18 to 40 years can apply online. The government also provides up to 25% margin money subsidy on the total loan amount. A detailed project report is mandatory for applying. This scheme is especially beneficial for SC/ST, OBC, women, and other weaker sections. All applications are approved through a district-level committee headed by the District Magistrate.

UP Yuva Swarozgar Yojana 2025: Highlights Table

| Particulars | Details |

| Scheme Name | UP Mukhyamantri Yuva Swarozgar Yojana |

| Launched By | Government of Uttar Pradesh |

| Implementing Department | MSME Department, Uttar Pradesh |

| Beneficiaries | Unemployed youth (18 to 40 years) |

| Loan Amount | ₹25 lakh for manufacturing, ₹10 lakh for services |

| Subsidy | 25% Margin Money (₹6.25 lakh max for manufacturing, ₹2.5 lakh for services) |

| Collateral | Not required for loans up to ₹4 lakh |

| Application Mode | Online |

| Official Website | diupmsme.upsdc.gov.in |

Objective of the CM Yuva Swarojgar Scheme

The main objective of the Mukhyamantri Yuva Swarozgar Yojana is to promote self-employment among the youth of Uttar Pradesh. Many skilled youth in the state want to start their own business but lack financial support. This scheme provides them with easy loan access and government subsidy to launch small manufacturing or service units. It not only helps reduce unemployment but also builds a strong base of young entrepreneurs. By supporting business-minded youth, the state government aims to create job opportunities, improve rural and urban economies, and uplift backward communities with special financial incentives.

Eligibility Criteria

To apply for this scheme, the applicant must meet the following conditions:

- Must be a permanent resident of Uttar Pradesh

- Age should be between 18 and 40 years

- Must have passed at least Class 10 (High School)

- Applicants Should not be a defaulter of any nationalized bank, financial institution, or cooperative bank

- Should not have taken benefits from similar government self-employment schemes

- Should be mentally and physically fit for the business

- Must submit a valid project report and affidavit

Benefits of the Scheme

- Financial loan up to ₹25 lakh for manufacturing businesses

- Financial loan up to ₹10 lakh for service sector businesses

- 25% margin money subsidy (maximum ₹6.25 lakh for manufacturing, ₹2.5 lakh for services)

- No guarantee or collateral needed for loans up to ₹4 lakh

- Interest subsidy as per rules for specific categories

- Special preference to SC, ST, OBC, women, ex-servicemen, minorities, and disabled candidates

- Support and guidance during business setup

Required Documents

To apply for this scheme, the following documents are necessary:

- Aadhar Card

- Domicile Certificate (proof of being a UP resident)

- Caste Certificate (for reserved category)

- High School Marksheet or Certificate

- Bank Passbook (with IFSC code)

- Recent Passport Size Photographs

- Active Mobile Number

- Valid Email ID

- Affidavit of eligibility

- Project Report of proposed business

Application Process – Step by Step

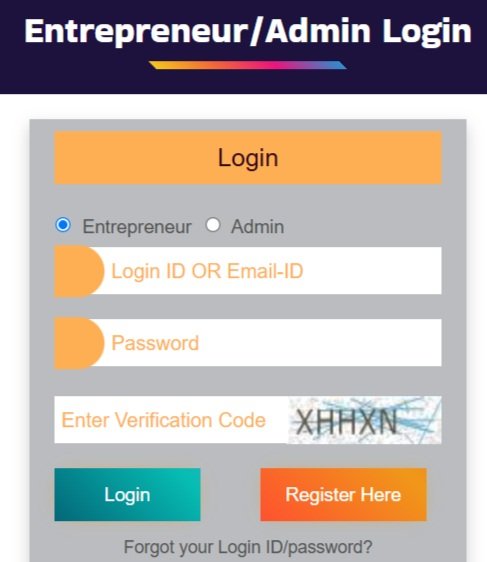

- Go to https://www.diupmsme.upsdc.gov.in

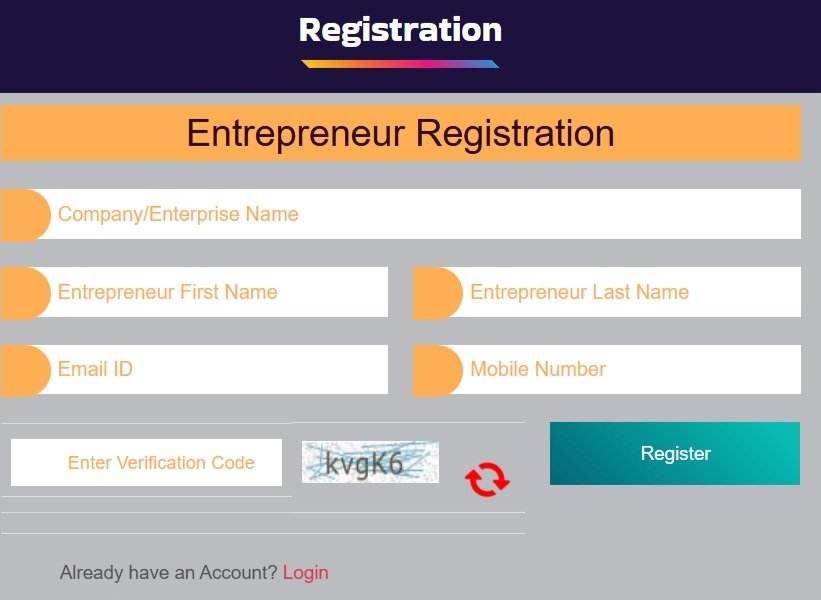

- Click on “Apply” and register with your mobile number and email

- After that, the applicant is redirected to another government website.

- Upload scanned copies of required documents including your project report

- After checking details, submit the form online

- District-level committee verifies all documents and business plan

- Approved applications are sent to the bank for loan processing and disbursement

- Use the funds to start your business as per your submitted project

Read Also: UP National Family Benefit Scheme (NFBS)

Frequently Asked Questions (FAQs)

Q1. What is the age limit to apply for this scheme?

Applicants must be between 18 and 40 years old.

Q2. How much loan can be availed under this scheme?

Up to ₹25 lakh for manufacturing and ₹10 lakh for service sector businesses.

Q3. Is there any subsidy available?

Yes, 25% margin money subsidy is provided by the government.

Q4. Is this loan collateral-free?

Yes, loans up to ₹4 lakh do not require any security or collateral.

Q5. Where to apply for this scheme?

Apply online at https://www.diupmsme.upsdc.gov.in

Q6. Is a project report necessary?

Yes, a project/business report is mandatory at the time of application.

Contacts

Invest UP

Picup Bhawan, Block A, 4th Floor, Lucknow, UP

Call: 0522-6923000, 9415157990, 9839222090

Email: info@investup.org.in